What is a Restaurant Payroll Software?

Restaurant payroll software helps food and beverage businesses to manage and pay their employees efficiently. Enables organizations to manage, monitor and streamline payroll processes. Allows HR to ensure that employees are paid accurately and on time. Enables users to calculate wages and tax deductions for each employee. Allows users to track absences, provide time off approvals, and create an administrative framework for tracking paid time off. Restaurant Payroll Software also enables users to generate and download various reports for payroll history, bank transactions, paid time off, etc.

Restaurant Payroll Software enables users to view employees’ historical records, receive notifications, and send attachments. Allows users to add notes and upload documents into each employee’s profile. Enables users to store employee information in the cloud and retrieve them at any time as per their requirements. It also allows HR to manage everyday tasks automatically, such as working overtime, early going and late coming.

Payroll is a multi-use word referring to the person receiving a paycheck from a company, their wages, and how the employee pays. Payroll is defined as several employees pays in fiscal terms, and it grew 2.5% in a single calendar year. Payroll refers to a process where the employee calculates and distributes salaries.

Features of a Restaurant Payroll Software

List of HRIS Software

When you start looking for the best HRIS software, it is easy to get overwhelmed with the list of options available. Here is the handpicked list of an HRIS software to choose as per your requirement:

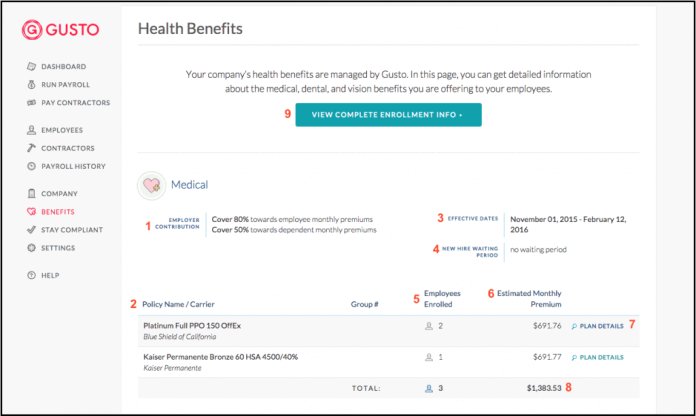

1. Gusto

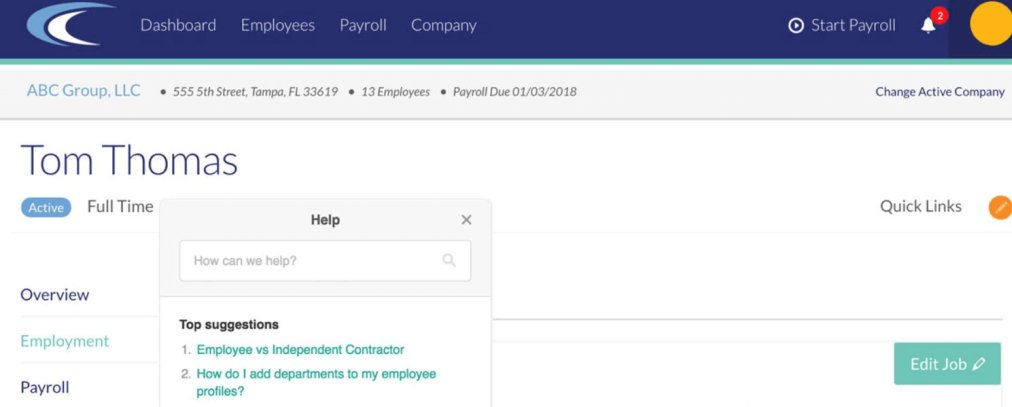

Gusto is a cloud-based best restaurant payroll software suitable for businesses of all sizes. Allows users to manage employee onboarding, run payroll, and engage employees and teams using one integrated and easy-to-use platform. Enables users to streamline the payroll process using integrated payroll software.

Gusto restaurant payroll software makes running payroll easy by offering full-service support for automatic payroll processing, tax filing, and payroll compliance.

Key Features:

- Provides access to both employees and employers to online pay stubs and any tax document

- Provides pricing across four different plans: Contractor plan, Core Plan, Complete Plan, and Concierge Plan

- Provides users with a one-month free trial before fully implementing the system

- Users can generate and download various reports for payroll history, bank transactions, paid time off, etc

To know more about Gusto Restaurant Payroll Software features and product options, click here to continue.

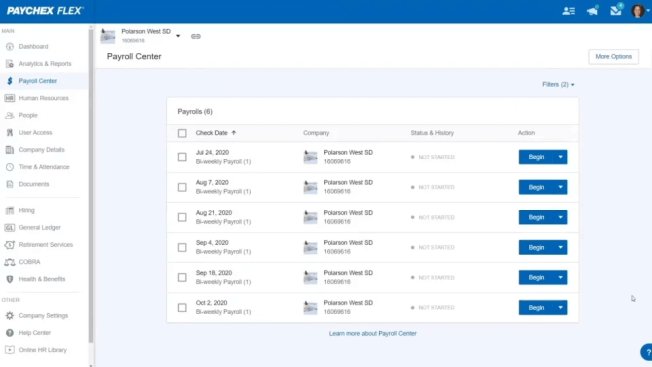

2. Paychex Flex

Paychex Flex is a cloud-based payroll software designed for businesses of all sizes. It includes automatic payroll tax calculation, reporting and analytics. Allows an employee to access their central database and view payslips, policies and other essential documents. Enables an employee to update allocations, view and update benefit information and track retirement balances.

Paychex Flex restaurant payroll software provides in-built templates to create customizable reports. Provides a 401(k) plan that enables employees to plan their retirement properly. It also provides a fair labor standards act.

Key Features:

- It supports multiple languages, such as English and Spanish

- Allows users to manage State and Federal tax filing

- Enables users to track employees time and attendance

- Provides a mobile app for iOS and Android

To know more about Paychex Flex Restaurant Payroll Software features and product options, click here to continue.

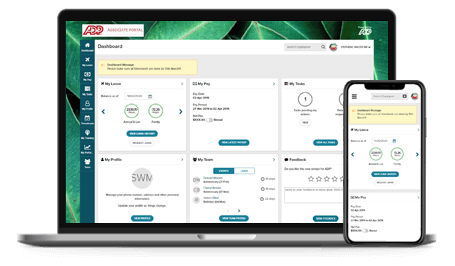

3. ADP Payroll

ADP Payroll is a cloud-based restaurant software designed for businesses of all sizes. It includes time and attendance tracking, employee self-service portal, performance management, compensation planning, employee benefits management, etc. It provides a straightforward user interface that allows HR managers to store pay stubs and annual reports securely.

ADP payroll software allows managers to create customizable payroll reports. Enables users to work in various languages, currencies and time zones. Allows users to filter reports based on payment period, employee information, etc. It also enables employees to view work schedules, download pay statements, and request time off.

ADP Payroll enables users to enhance security and improves your business to make payroll information more targeted. It also provides a 401(k) plan that enables employees to plan their retirement properly.

Key Features:

- Allows users to integrate with other business systems, such as Sage People, ADP BizPro, EMP Trust HR, etc

- Provides a mobile app for iOS and Android

- Provides a 256-bit Secure Sockets Layer (SSL) encryption

- It also complies with the Affordable Care Act (ACA)

To know more about ADP Restaurant Payroll Software features and product options, click here to continue.

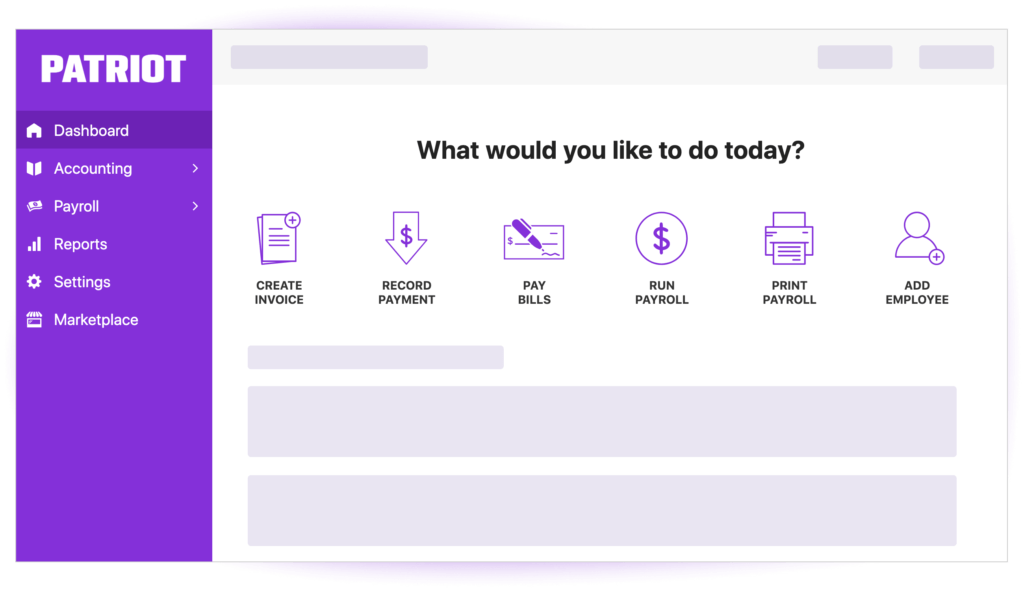

4. Patriot

Patriot is one of the top restaurant payroll software suitable for businesses of all sizes., such as engineering, retail, and maintenance or field service industries. Allows users to streamline the various processes for managing tax submissions and payroll payments. Enables users to print and download W-2 forms for tax reporting.

Patriot restaurant payroll software also allows HR managers to maintain print checks, generate payroll reports, maintain payroll records, and submit federal and state taxes.

Key Features:

- Patriot payroll system allows an employee to modify federal tax withholdings

- Enables an employee to check and edit personal information

- Enables users to integrate with other patriot software

- It also provides a 30-day free trial and works on Mac, Windows and Linux

To know more about Patriot Restaurant Payroll Software features and product options, click here to continue.

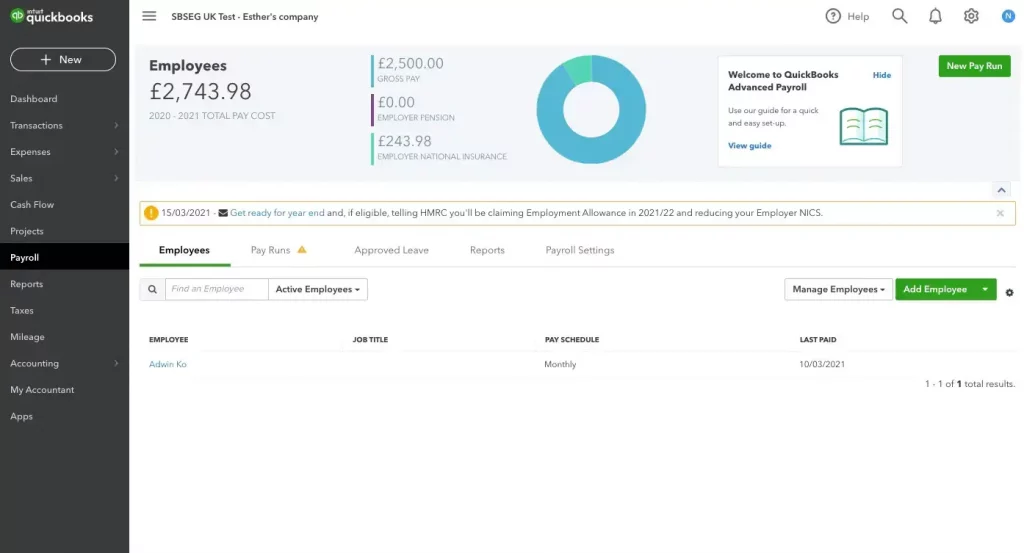

5. QuickBooks

QuickBooks is a web-based payroll service designed for small business owners. Allows users to serve clients across various geographical regions and manage compensation calculation, meet minimum wage requirements, benefits administration, attendance tracking, direct deposit, onboarding processes, etc. Enables HR to resolve errors and repay penalty charges while submitting federal and state taxes. Intuit QuickBooks payroll software provides legal policies on federal and state laws for overtime rules and employee compensation.

Key Features:

- Enables HR managers to share real-time payroll information with their team members

- Allows you to submit payroll tax electronically

- Allows users to integrate with Quickbooks Online and ADP Workforce

- Provides a mobile app for iOS and Android

To know more about QuickBooks Restaurant Payroll Software features and product options, click here to continue.

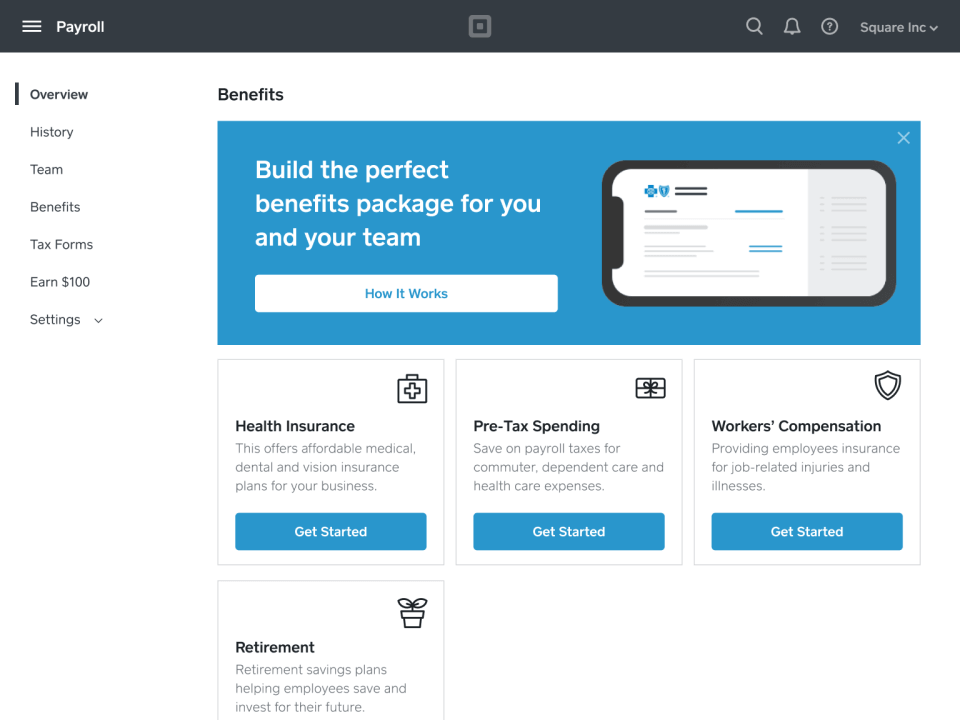

6. Square Payroll

Square Payroll is a web-based automated payroll processing software suitable for the restaurant industry of all sizes. It includes benefits management, processing payroll quickly, automated tax filing, etc. Enables managers to pay employees on an hourly basis. Allows employees to update personal information, such as tax withholdings and bank account details.

Square payroll platform enables an admin to set permissions and determine access to individuals as per their requirements. Allows managers to calculate employee overtime and commissions and monitor employees clock in and out.

Key Features:

- Allows users to integrate with payroll solutions and accounting software, such as ADP Workforce, Square POSa and QuickBooks payroll

- Square payroll provides a mobile app for iOS and Android

- Square payroll enables users to print and download W-2 forms for tax reporting

- It also enables users to submit federal and state taxes as per tax laws

To know more about Square Restaurant Payroll Software features and product options, click here to continue.

7. SurePayroll

SurePayroll is an online payroll service for small to midsize business systems. It includes legal compliance, tax compliance, workers’ compensation, direct deposit and payroll calculation. Allows HR managers to pay their employees by direct deposits and printed checks.

SurePayroll provides multiple payment options, such as same-day or next-day payroll processing. SurePayroll provides a 401(k) plan that enables employees to plan their retirement properly.

Key Features:

- Enables users to integrate with Kashoo, Xero, QuickBooks, etc

- Provides a mobile app for iOS and Android

- Allows users to calculate state and federal tax automatically

- It also provides a 60-day free trial

To know more about SurePayroll Software features and product options, click here to continue.

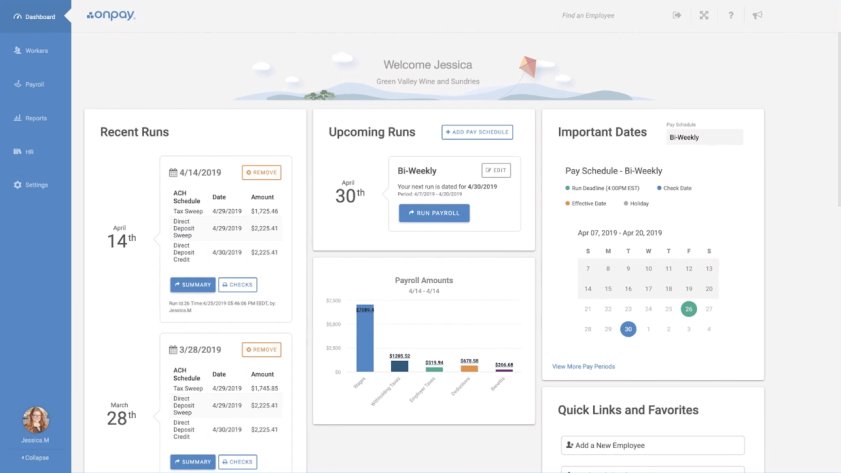

8. OnPay

OnPay is a cloud-based payroll application suitable for businesses of all sizes. It includes automated payroll, new hire reporting, scheduled pay runs, managing multiple pay rates and employee self onboarding. Allows HR to track employees’ sick leaves and sick leaves. Enables an employee to store information in a centralized database, such as notes and contracts for data security.

OnPay software allows managers to schedule and disburse wages automatically. It provides a 401(k) plan that enables employees to plan their retirement properly. It also provides a one-month free trial.

Key Features:

- Allows users to integrate with QuickBooks, Xero, Kabbage, Guideline, etc

- Enables employees to access their W2 forms and payslips

- Allows users to calculate federal and state payroll taxes

- Supports multiple languages, such as English, and Spanish

To know more about OnPay Restaurant Payroll Software features and product options, click here to continue.

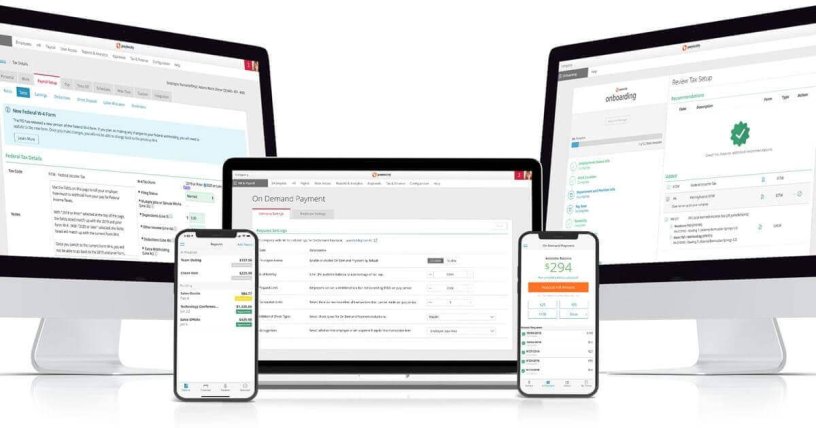

9. Paylocity

Paylocity is a cloud-based restaurant payroll application designed for businesses of all sizes, such as manufacturing, healthcare, education and financial services. It includes time tracking, benefits administration, employee engagement, direct deposit, talent management, and applicant tracking system. Allows users to automate payroll processes and eliminate payroll calculators and spreadsheets. Paylocity payroll software enables employees to read company news, request time off, and access payment information.

Key Features:

- Allows restaurant employees to manage wage garnishment services and provides tax management tools

- Enables HR to view, correct and validate employee paychecks

- Allows users to manage Human Resources functions using custom checklists, quick-edit templates, etc

- Provides a mobile app for iOS and Android

To know more about Paylocity Restaurant Payroll Software features and product options, click here to continue.

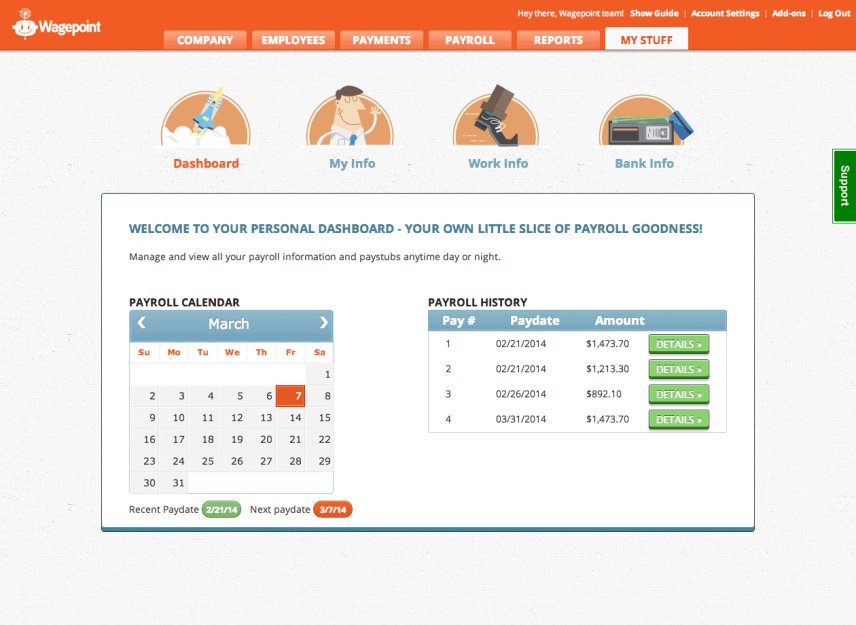

10. Wagepoint

Wagepoint is one of the best restaurant payroll providers designed for businesses of all sizes, such as retail, healthcare, and banking. Allows users to view and download payslips, 1099s, W2s and state and federal government tax reporting. Enables users to add various pay groups for various schedules.

Wagepoint restaurant payroll processing software also enables users to calculate accurate payroll and pay periods hourly. Allows users to integrate with LessAccounting, QuickBooks, Slack, etc.

Key Features:

- It provides 256-bit SSL encryption

- Available on web-based and desktop (Mac and Windows)

- Supports multiple currencies

- It also complies with IRS regulations

To know more about Wagepoint Restaurant Payroll Software features and product options, click here to continue.

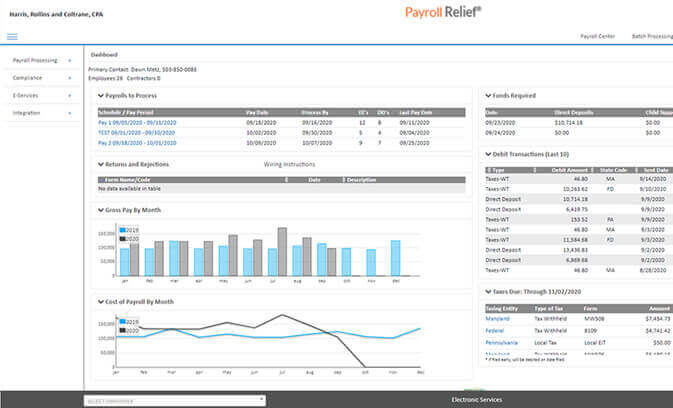

11. Payroll Relief

Payroll Relief is a cloud-based robust payroll software suitable for businesses of all sizes. Enables HR to monitor employees allowances and manage payroll tax forms and tax filings. It also enables users to distribute payroll expenses based on job role and department.

Payroll Relief, a restaurant payroll software, allows users to comply with local and state regulations. Allows HR to import payroll data and streamline approval processes.

Key Features:

- Enables users to integrate with QuickBooks, Sage business cloud payroll, Creative Solutions, etc

- Provides a mobile app for iOS and Android

- Allows users to access fringe benefits details

- It also enables users to create payroll reports

To know more about Payroll Relief Restaurant Payroll Software features and product options, click here to continue.

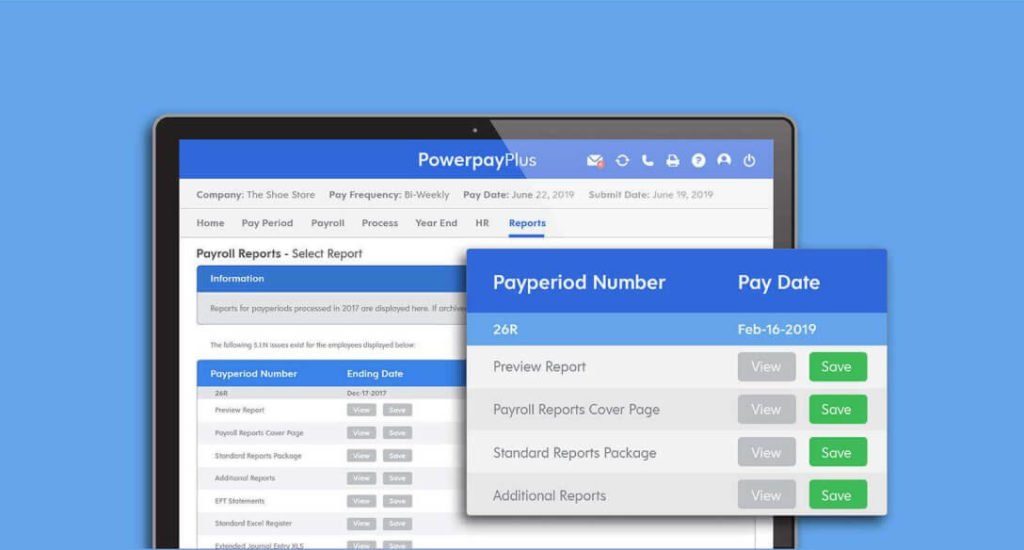

12. PowerPay

Powerpay is one of the best restaurant payroll software designed for businesses of all sizes. Allows users to automate payroll processes and remains compliant as per government regulations. Enables users to create and analyze reports for decision-making purposes. It also allows HR to store tax documents and employment records securely. Powerpay payroll cloud-based software enables users to manage payroll based on overtime, vacations, and employee working hours.

Powerpay payroll application enables employees to update personal information, including bank account details, and view, download, and print payslips. Allows HR to track employees working hours and calculate compensation automatically. It also enables an admin to gain visibility into financial reports.

Key Features:

- Allows users to integrate with QuickBooks Online and QuickBooks bookkeeping

- Supports multiple languages, such as English and French

- Enables an employee to view work schedules and send leave requests to managers

- It also provides a mobile app for iOS and Android

To know more about PowerPay Restaurant Payroll Software features and product options, click here to continue.

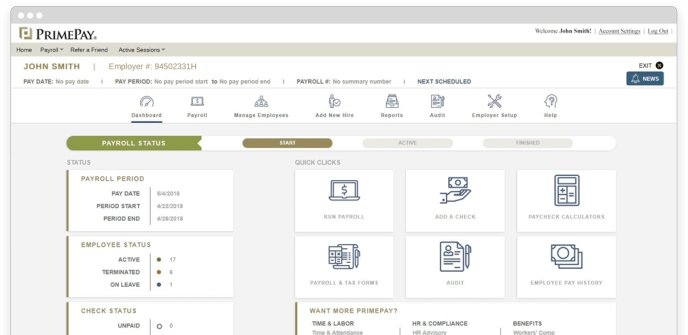

13. PrimePay

PrimePay is a cloud-based restaurant payroll service designed for businesses of all sizes. It includes compliance management, payroll tax services, benefits administration, and check payment options. Allows an admin to create reports with standard templates, such as tax summaries and bank reconciliation.

PrimePay restaurant payroll software system also allows users to calculate salaries on an hourly basis. Enables users to track pay statements and create custom reports on taxes for paying employees.

Key Features:

- Enables users to submit local, state and federal income tax

- Enables users to integrate with Microsoft Word and QuickBooks

- It provides two-factor authentication for more reliable security

- Provides a mobile app for iOS and Android

To know more about PrimePay Restaurant Payroll Software features and product options, click here to continue.

14. BrightPay

BrightPay is one of the best restaurant payroll providers suitable for businesses of all sizes, including advertising, construction, accounting, transportation, and retail. It includes benefits management, online annual leave management, accurate tax calculations and custom payslips. Allows users to email and print payslips and customize checks with logo and address.

BrightPay payroll software enables HR to calculate taxes automatically. It also provides a cloud backup functionality that allows users to automatically backup payroll information to the cloud.

Key Features:

- Allows users to integrate with the Xero accounting application

- Provides a mobile app for iOS and Android

- Available on-premise and on desktop (Mac and Windows)

- It also provides a 60-day free trial

To know more about BrightPay Restaurant Payroll Software features and product options, click here to continue.

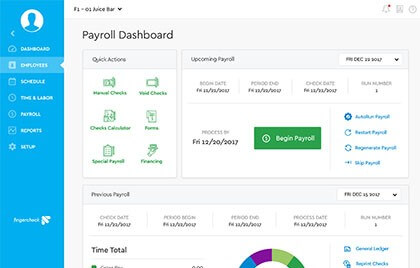

15. Fingercheck

Fingercheck is an affordable payroll software designed for businesses of all sizes. It includes benefits administration, time and attendance tracking, insurance management and self on-boarding. Allows users to schedule and preview payroll. Enables users to monitor personal expenses to categorize them and specify recurring expenses.

Fingercheck payroll solution allows HR managers to monitor employees working hours and attendance using biometric fingerprints, facial recognition technology, and web punch-ins. It also enables users to create 1099 and W-2 taxes.

Key Features:

- Enables users to calculate pay based on timesheets to avoid errors

- Allows users to ensure compliance with federal and state tax regulations

- Enables HR to store employees’ data in a centralized database

- Provides a mobile app for iOS and Android

To know more about Fingercheck Restaurant Payroll Software features and product options, click here to continue.

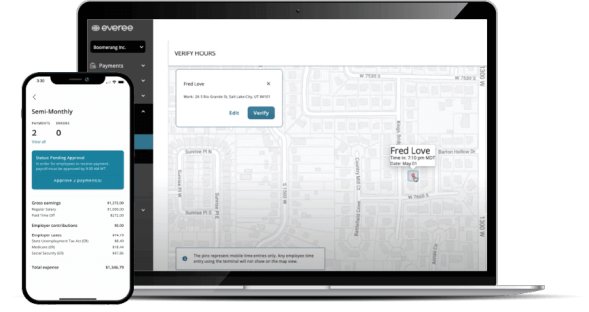

16. Everee

Everee is one of the best cloud-based payroll tools for businesses of all sizes. It includes automatic notifications, attendance and time tracking, payroll management, etc. Allows HR managers to approve timesheets and run payroll quickly. Enables employees to send notifications to their managers whenever discrepancies are found, and action needs to be taken.

Everee payroll management system allows users to store documents and synchronize payroll data in a centralized database. Allows HR to track employees' clock-in and out times to approve working hours. It also enables users to export payroll information to accounting software for auditing.

Key Features:

- Enables users to integrate with other payroll solutions, such as Quickbooks payroll

- Allows users to calculate salaries based on per day, weekly and monthly basis

- Enables users to view W2 and 1099 forms and submit federal and state taxes

- Provides a mobile app for iOS and Android

To know more about Everee Restaurant Payroll Software features and product options, click here to continue.

17. CheckMark

CheckMark is one of the best restaurant payroll software suitable for businesses of all sizes. Allows HR to customize deductions and pay their employees by direct deposit. It provides a 401(k) plan that enables employees to plan their retirement properly. Enables users to print MICR encoding, 944’s, 943’s, 940’s, 941’s, and forms on blank paper. CheckMark payroll solution also allows managers to email pay stubs to their employees.

Key Features:

- Allows users to integrate with other payroll solutions, such as QuickBooks

- Available on-premise and cloud-based

- Enables users to submit W-3s and W-2s taxes

- It also provides a 60-day free trial

To know more about CheckMark Restaurant Payroll Software features and product options, click here to continue.

18. CertiPay

CertiPay is a cloud-based restaurant payroll software designed for small to midsize businesses. Allows HR managers to receive emails about paid time off (PTO) requests. Enables users to schedule and process payroll quickly as per their requirements automatically. It also allows employees to receive payments via paper checks and direct deposits.

CertiPay payroll solution allows HR to update compensation and access the tax documents of their staff members. Enables managers to gain visibility into deductions, employment details, employee demographics, etc.

Key Features:

- Provides a 256-bit Secure Sockets Layer encryption

- Allows managers to manage W-2 preparation and filing

- Provides a 256-bit Secure Sockets Layer encryption

- It also complies with ACA (Affordable Care Act)

To know more about CertiPay Restaurant Payroll Software features and product options, click here to continue.

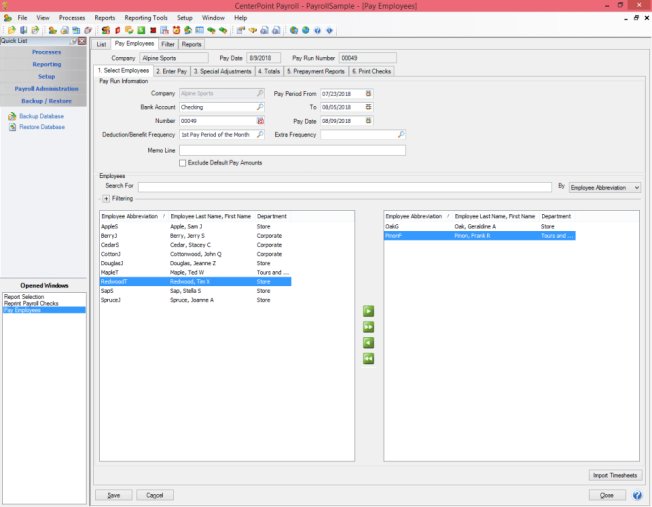

19. CenterPoint Payroll

CenterPoint Payroll is one of the best restaurant payroll software designed for businesses of all sizes. It includes automatic tax compliance, tracking multiple payroll entities, managing deductions, compensation management etc. It also allows users to import employees' data or information from CSV and Excel files.

CenterPoint payroll solution enables users to create links to employees' documents, including W4 and I9 forms, employee photos and resumes. Allows users to create customizable reports and store them for future reference.

Key Features:

- Allows users to calculate and manage payroll on a weekly and monthly basis

- Available on-premise and cloud-based

- Enables users to print MICR coding on blank checks

- Allows users to submit federal and state payroll taxes

To know more about CenterPoint Restaurant Payroll Software features and product options, click here to continue.

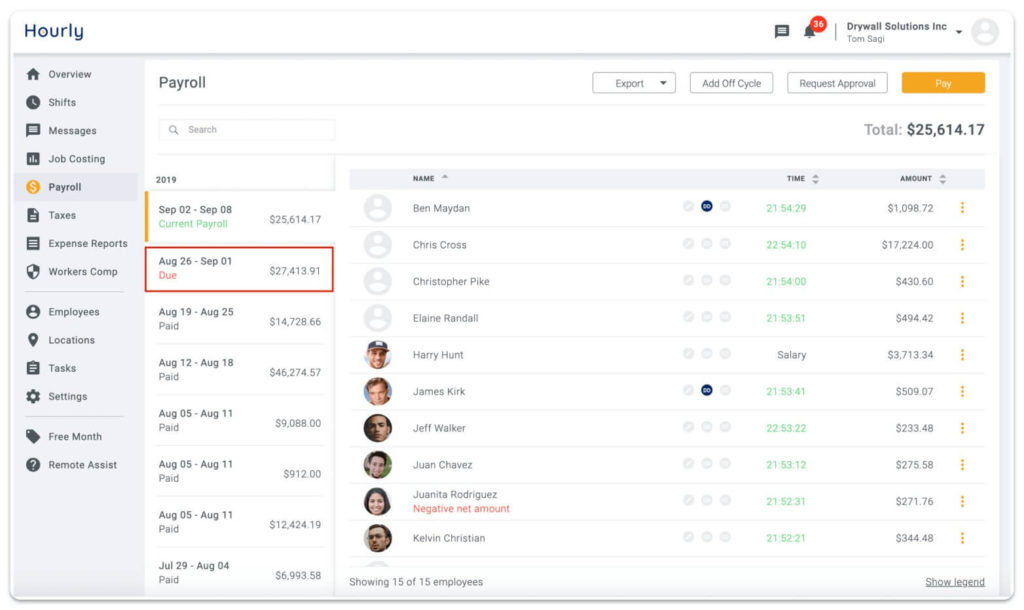

20. Hourly

Hourly is one of the best restaurant payroll software suitable for small to midsize businesses of all sizes. It includes pay schedules, automatic payroll tax filing, tax compliance, self Service portal, detailed payroll reports, direct deposit, sick leave tracking, and biometric recognition. Allows users to track working hours and manage payroll automatically. Hourly payroll software enables managers to track the working hours of field technicians using GPS in real-time.

Key Features:

- Allows an employee to view payslips and tax forms and update personal details

- Enables users to manage federal and state tax filing automatically

- Supports multiple languages, such as English, and Spanish

- It also provides a mobile app for iOS and Android

To know more about Hourly Restaurant Payroll Software features and product options, click here to continue.

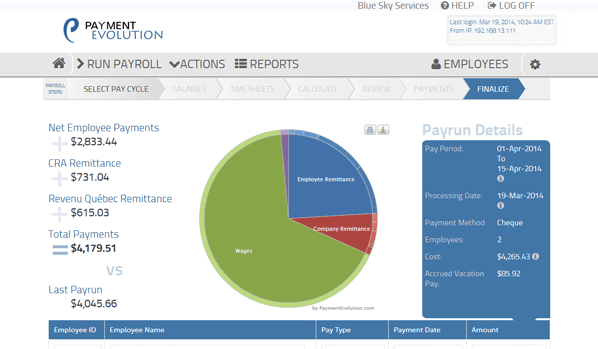

21. Payment Evolution

Payment Evolution is one of the best restaurant payroll software suitable for businesses of all sizes. Enables users to calculate payroll taxes, manage payroll, and minimum wage requirements, prepare checks, etc. Allows users to calculate state and federal taxes automatically. It also enables HR managers to calculate and pay salaries weekly and monthly. Payment Evolution software enables managers to create tax liability reports, employee earnings, taxation reports, and journal reports.

Payment Evolution payroll software lets users print W2 forms and MICR coding blank paper. Enables users to track time, attendance, and vacation and adjust their salary. Allows users to calculate payroll with state and federal payroll taxes withholdings.

Key Features:

- Allows an employee to view payslips and tax forms and update personal details

- Enables users to manage federal and state tax filing automatically

- Supports multiple languages, such as English, and Spanish

- It also provides a mobile app for iOS and Android

To know more about Payment Evolution Restaurant Payroll Software features and product options, click here to continue.

22. Deluxe Payroll

Deluxe Payroll is a cloud-based restaurant payroll software suitable for businesses of all sizes. It includes wage calculations, direct deposits, automatic payroll tax calculations, time tracking, and benefits management. Allows managers to calculate, preview and submit payroll in real-time.

Deluxe payroll management software enables users to submit taxes, including W2s and 1099s. It also allows employees to access their paychecks to view paid leaves and regular compensation.

Key Features:

- Enables users to integrate with G-Suite, Slack, Microsoft Dynamics 365, etc

- It supports Multiple Payment methods

- Allows users to manage tax calculations and remittances

- It also complies with the Affordable Care Act (ACA)

To know more about Deluxe Restaurant Payroll Software features and product options, click here to continue.

23. Uzio

UZIO is a cloud-based payroll software suitable for businesses of all sizes. It provides employers and employees with single sign-on access to centralize their Human resources tasks, manage employee wages, employee benefits management, and online payroll processing. UZIO software automates HR administrative tasks, record-keeping, and compliance.

UZIO payroll management software provides a self-service people operations platform that allows employers to go paperless and navigate employee management complexities in a few clicks.

Key Features:

- UZIO payroll management system enables you to manage all your company’s benefit offerings in one place

- It also automatically updates any changes made in the employee compensation and will reflect across the system

- Allows us to automate Human Resources processes, collect, classify, process, store, and distribute required information

- Provides hassle-free, efficient, and automated processing of the employee’s pay cycle

To know more about Uzio Restaurant Payroll Software features and product options, click here to continue.

24. Rippling

Rippling is a restaurant payroll software suitable for businesses of all sizes. Allows users to manage the company’s Payroll, Human Resources, and IT in one unified platform. Enables users to maintain all of their employee systems, manage minimum wage laws, centralize employee data and help automate their busy work. It allows users to unify employee records or data whether your business has one employee or 1,000 employees.

Rippling restaurant payroll software also provides a mobile app and self-service portal so that employees can monitor and rectify any errors that occur with their information.

Key Features:

- Rippling payroll management system is a user-friendly software and provides excellent customer service support

- It can be integrated with various business systems to ensure an organized data management system

- Rippling makes it easy for employees to get paid, track PTO, and do open healthcare enrollment

- Can connect to software that your company already has and syncs data across all of these systems

To know more about Rippling Restaurant Payroll Software features and product options, click here to continue.

25. Ascentis

Ascentis is a full-service payroll designed for businesses of all sizes. Allows users to manage the workforce while maintaining compliance with federal mandates easily. It allows users to manage recruiting, onboarding, performance management, minimum wage alerts, workforce management, talent management, attendance and time tracking, and payroll.

Ascentis, a payroll software, provides insights into trends with deep analytics within employee metrics. Provides a fully automated time and attendance solution that features online timesheets, clock-in/out functionality, scheduling, etc.

Key Features:

- Available as a single HCM solution or can be purchased as separate modules that integrate with other solutions

- Increases employee engagement and satisfaction through self-service functionality

- Supports online enrollment, saves the HR department time and eliminates unnecessary paperwork

- Allows us to process payroll in real-time and ensure 100% accuracy

To know more about Ascentis Restaurant Payroll Software features and product options, click here to continue.

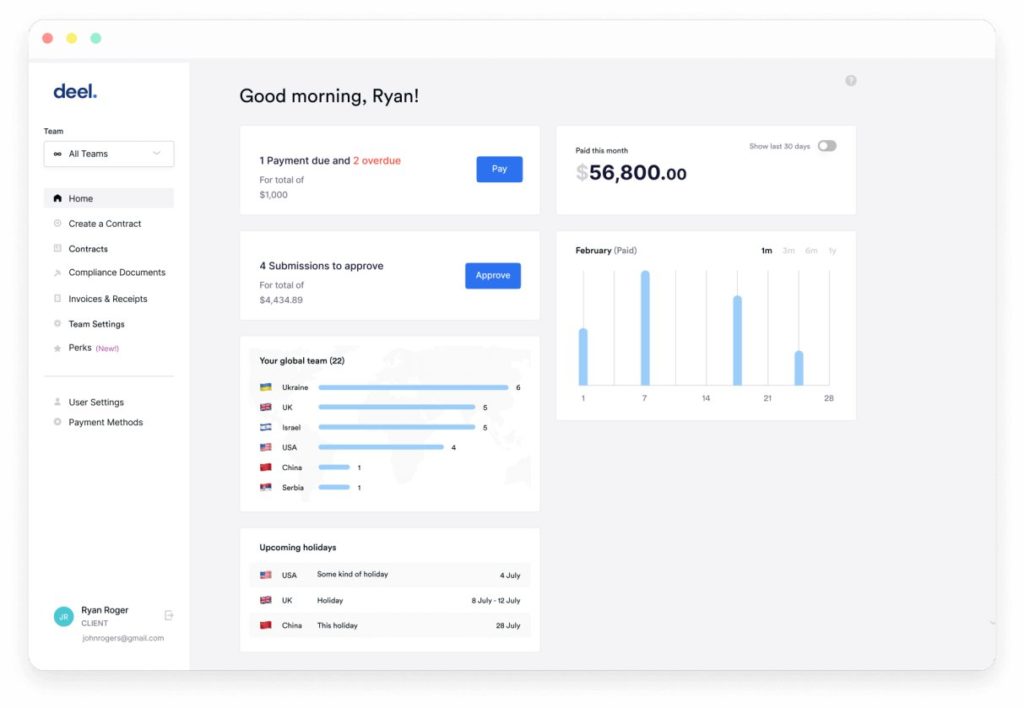

26. Deel

Deel is a full-service payroll suitable for businesses of all sizes. It provides automated payroll management systems that allow users to hire anyone quickly and from anywhere. Allows Contractors to deposit and withdraw funds in 120+ currencies.

Deel payroll cloud-based software enables users to manage payroll in 10+ payment methods, including Payoneer, Revolut, Coinbase, etc. It also enables HR to pay employees on time.

Key Features:

- Enables users to integrate with reporting and accounting software

- Allows users to hire a remote employee from 150+ countries

- It complies with General Data Protection Regulation

- It also supports Single Sign-On (SSO) authentication

To know more about Deel Restaurant Payroll Software features and product options, click here to continue.

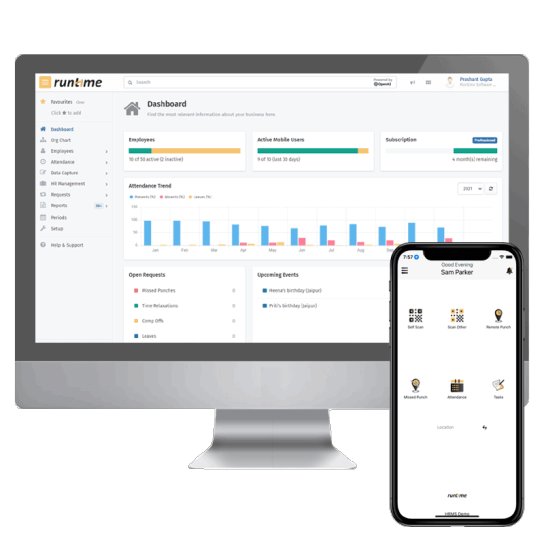

27. Runtime

Runtime is a full-service payroll designed for businesses of all sizes. Allows users to prepare employee payroll automatically. Enables users to store employee information in the cloud and retrieve it at any time per their requirements. Allows users to track the visibility of employee attendance in real-time.

Runtime payroll management system also enables users to manage everyday tasks automatically, such as track time and attendance or early going and late coming. It also provides a free trial with limited features.

Key Features:

- Provides a mobile app for iOS and Android

- Runtime payroll software cost (basic payroll package) starts from 4 dollars a month

- Allows users to send payslips to all or specific employees

- Enables users to synchronize attendance with biometric functionality

To know more about Runtime Restaurant Payroll Software features and product options, click here to continue.

Conclusion

Restaurant Payroll Software streamlines business operations while reducing unnecessary work time. Payroll solutions include less paperwork, improved accuracy, and reduced administrative tasks. Allows users to eliminate human error. Enables employees to report time (in real-time or after-the-fact) for wage calculation purposes. It also allows users to give rewards to their employees based on performance.

Frequently Asked Questions

What is the best payroll software to pay employees?

1) Gusto streamlines the payroll using integrated payroll software and makes running payroll easy by offering full-service support for automatic payroll processing, tax filing, and payroll compliance.

2) Paychex Flex enables an employee to update allocations, view and update employee benefits information and track retirement balances. Provides in-built templates that allow users to create customizable reports. It also provides a 401(k) plan that enables employees to plan their retirement properly. Allows users to manage State and Federal tax filing.

3) QuickBooks payroll software provides legal policies on federal and state laws for overtime rules and employee compensation. Enables HR to resolve errors and repay penalty charges while submitting state and federal tax.

4) OnPay allows HR to track employees’ sick leaves and sick leaves. Enables an employee to store information in a centralized database, such as notes and contracts. Allows managers to schedule and disburse wages automatically. It provides a 401(k) plan that enables employees to plan their retirement properly.

5) ADP Payroll software allows managers to create customizable payroll reports. Enables users to work in various languages, currencies and time zones. Allows users to filter reports based on payment period, employee information, etc. It also enables employees to view work schedules, download pay statements, and request time off.

What is the best payroll software to calculate and manage payroll taxes?

1) Square Payroll software enables an admin to set permissions and determine access to individuals as per their requirements. Allows restaurant owners to calculate employee overtime and commissions and monitor employees clock in and out. Enables managers to pay employees on an hourly basis. Square payroll also allows employees to update personal information, such as tax withholdings and bank account details.

2) Deluxe Payroll allows restaurant owners to calculate, preview and submit payroll in real-time. Enables users to submit taxes, including W2s and 1099s. Allows employees to access their paychecks to view paid leaves and regular compensation. It supports Multiple Payment methods.

3) Rippling allows restaurant owners to unify employee records or data whether your business has one employee or 1,000 employees. It provides a mobile app and self-service portal to monitor and rectify any errors that occur with their information.

4) Patriot payroll software allows HR managers to maintain print checks, generate payroll reports, maintain payroll records, and submit federal and state taxes. Enables an employee to check and edit personal information.

5) SurePayroll provides multiple payment options, such as same-day or next-day payroll processing. SurePayroll provides a 401(k) plan that enables employees to plan their retirement properly.

6) Paylocity payroll software enables employees to read company news, request time off, and access payment information. Allows users to automate payroll processes and eliminate payroll calculators and spreadsheets.

7) Payroll Relief enables HR to monitor employees' allowances and manage payroll tax filings. It also enables users to distribute payroll expenses based on job role and department.