What is a Payment Processing Software?

Payment Processing Software plays a crucial role in online and point-of-sale (POS) transactions by securely handling the transfer of funds between customers and businesses. It supports credit/debit cards, digital wallets (e.g., Apple Pay, Google Pay), bank transfers, and other payment methods. Users can encrypt sensitive data, such as credit card information, to ensure secure transmission and storage. In addition, users can process transactions in different currencies for businesses with an international customer base.

Payment Processing Software supports electronic bank-to-bank transfers, enabling businesses to accept payments directly from customers' bank accounts. Users can replace sensitive information (such as credit card numbers) with unique tokens, reducing the risk of data breaches. It can identify and prevent fraudulent transactions to protect both merchants and customers.

Features of a Payment Processing Software

List of Payment Processing Software

When you start looking for the best payment processing software, it is easy to get overwhelmed with the list of options available. Here is the handpicked list of payment processing software to choose as per your requirement:

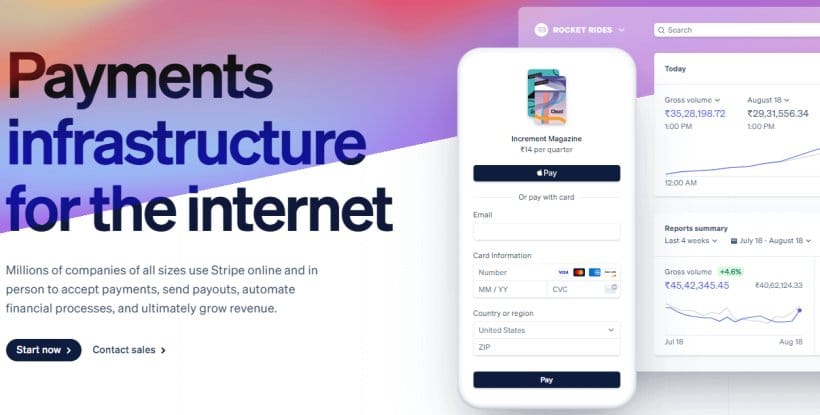

1. Stripe

Stripe is a payment processing software that allows businesses to accept online payments. It uses machine learning and customizable rules to detect and prevent fraudulent transactions. It supports various payment methods including credit and debit cards, digital wallets (e.g., Apple Pay, Google Pay), and ACH transfers. In addition, it allows businesses to automate processes based on specific events, such as successful payments or chargebacks.

Stripe facilitates subscription-based billing for businesses offering services or products regularly. Allows businesses to calculate and apply taxes to transactions based on the customer's location and applicable tax rules.

Key Features:

- Allows businesses to create and send invoices to streamline invoicing and payment process

- Businesses can receive funds instantly rather than waiting for the standard settlement period

- Businesses can create custom reports to analyze transaction data and gain insights into sales and customer behaviour

- It complies with PCI DSS and uses encryption and other security measures to protect sensitive customer data

To know more about Stripe Payment Processing Software features and product options, click here to continue.

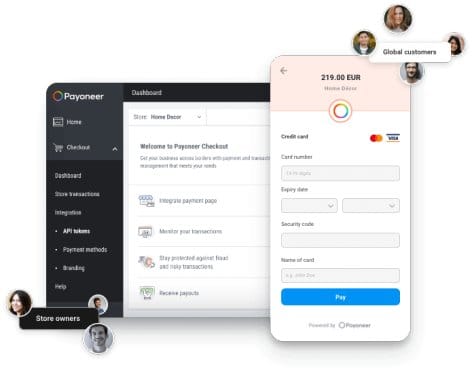

2. Payoneer

Payoneer is a payment processing software that enables businesses to send and receive funds globally. Users can receive payments in different currencies and convert them to their local currency if necessary. It offers escrow services for secure transactions, particularly in business-to-business (B2B) transactions where a trusted third party holds funds until certain conditions are met. In addition, it provides transparent information about fees and exchange rates, ensuring that users are aware of the costs associated with their transactions.

Key Features:

- It offers a prepaid Mastercard linked to the Payoneer account, allowing users to make purchases online or withdraw funds from ATMs where Mastercard is accepted

- It supports various payment methods, including bank transfers, credit/debit cards, and other local payment options, providing flexibility for users and payers

- Users can track the status of their payments in real-time, allowing for transparency and visibility into transaction details

- Users can send payment requests and invoices to clients or customers to streamline the billing process

To know more about Payoneer Payment Processing Software features and product options, click here to continue.

3. PayPal

PayPal is a payment processing software that allows businesses to make and receive payments securely through credit/debit cards, bank transfers, and PayPal accounts. It offers a streamlined checkout process, reducing the number of steps required for customers to complete a purchase. Allows businesses to create and send professional invoices to clients, with the option for clients to pay directly through PayPal. In addition, it can automatically convert the transaction amount into the customer's preferred currency, providing transparency and flexibility in international transactions.

Key Features:

- Users can integrate with e-commerce platforms and shopping carts to provide a secure and seamless payment experience for online shoppers

- It can send instant notifications for successful transactions, refunds, and other important events to both businesses and customers

- Repeated customers can make purchases with a single touch or click, without re-entering payment and shipping information

- It complies with the Payment Card Industry Data Security Standard (PCI DSS) to protect sensitive payment information

To know more about PayPal Payment Processing Software features and product options, click here to continue.

4. Square

Square is a payment processing software that enables businesses to accept payments via credit and debit cards. It offers a business debit card, known as the Square Card, which allows businesses to spend their Square balance immediately and track expenses. Allows businesses to create and sell gift cards to increase customer loyalty and generate additional revenue. In addition, it supports contactless payments and mobile wallets, allowing customers to pay using NFC technology or mobile devices.

Key Features:

- Allows businesses to create and send invoices to customers to receive payments securely

- It helps businesses track customer information, preferences, and purchase history

- It provides chargeback protection to help businesses deal with disputed transactions

- It provides a POS system that can be used on tablets and smartphones

To know more about Square Payment Processing Software features and product options, click here to continue.

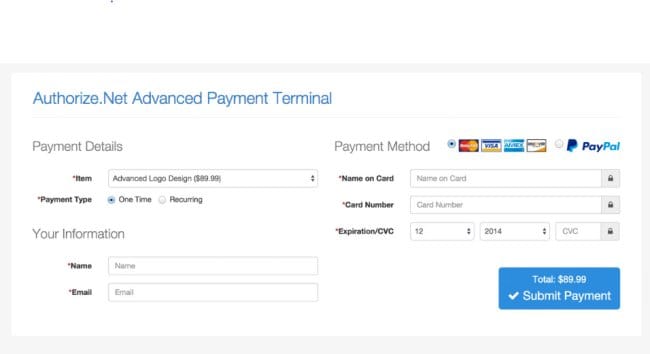

5. Authorize.Net

Authorize.Net is a payment processing software that allows merchants to accept credit cards, debit cards and electronic check payments through their website. Businesses can accept payments in multiple currencies, catering to a global customer base and simplifying international transactions. Merchants can set up automatic email notifications to customers for various transaction-related events, such as order confirmation and payment receipt. In addition, it facilitates recurring billing for subscription-based businesses by allowing merchants to set up and manage automated and scheduled payments.

Key Features:

- It supports popular digital wallets, such as Apple Pay and Google Pay, providing customers with convenient and secure payment options

- It includes PCI DSS compliance, encryption, and tokenization, to protect sensitive customer data and prevent fraudulent transactions

- Businesses can create and send invoices to customers, providing a convenient way to request and process payments

- Users can integrate with accounting software like QuickBooks to streamline financial management processes

To know more about Authorize.Net Payment Processing Software features and product options, click here to continue.

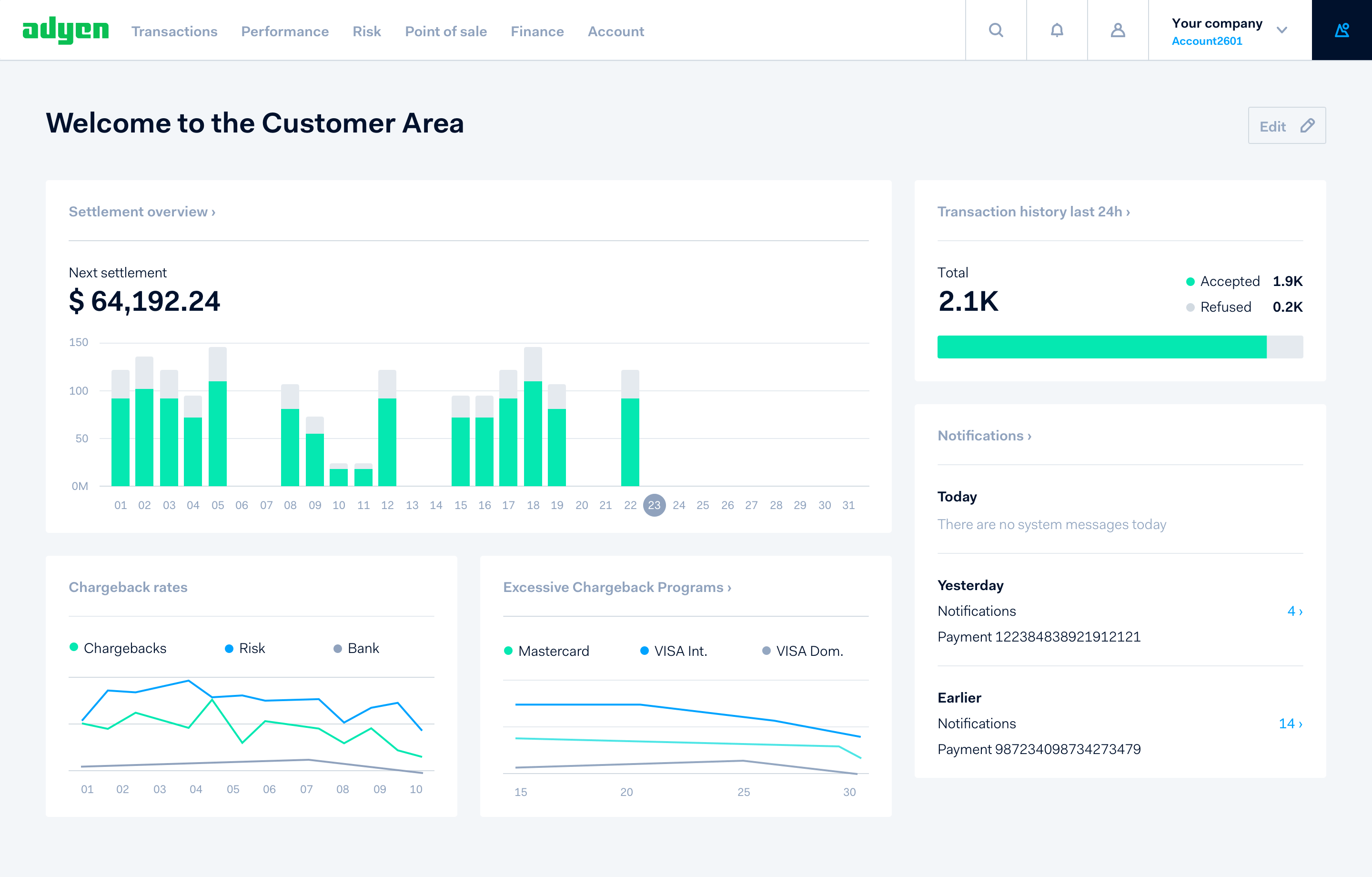

6. Adyen

Adyen is a payment processing software that enables businesses to receive payments via credit cards, debit cards, and digital wallets. It uses tokenization to replace sensitive cardholder data with unique tokens and enhances security while storing and transmitting sensitive information. Provides secure storage of customer payment data, reducing the burden on merchants to manage sensitive information and enhancing the overall security of transactions. In addition, it can handle transactions in multiple currencies, facilitating international businesses to receive payments in their preferred currency.

Key Features

- Allows merchants to gain insights into transaction data and customer behaviour to make informed decisions and optimize their payment processes

- It supports subscription-based and recurring billing models, making it suitable for businesses that offer services or products with ongoing payments

- It uses machine learning algorithms to detect and prevent fraudulent transactions and minimize the risk of chargebacks

- Merchants can customize the checkout flows to align with their branding and user experience preferences

To know more about Adyen Payment Processing Software features and product options, click here to continue.

7. Global

Global payment processing software allows businesses to handle transactions in multiple currencies. Users can handle the complexities of cross-border transactions, including currency conversion, and compliance with international regulations. It uses tokenization to replace sensitive cardholder data with unique tokens to reduce the risk of data breaches. In addition, businesses can detect and prevent fraudulent activities, enhancing the overall security of payment transactions.

Key Features:

- It can send instant notifications to businesses and customers regarding successful transactions, pending payments, or other relevant updates

- It supports recurring billing for subscription-based services to automate regular payments and manage subscription plans effectively

- It complies with the Payment Card Industry Data Security Standard (PCI DSS) to protect sensitive payment information

- Businesses can split payments among multiple recipients or allocate funds to different accounts

To know more about Global Payment Processing Software features and product options, click here to continue.

8. Razorpay

Razorpay is a payment processing software that enables businesses to accept payment via credit/debit cards, net banking, UPI, and various digital wallets. Users can send invoices and payment links to customers, track payments and send reminders to streamline the invoicing process. Provides secure storage of card information for easier and faster subsequent transactions to reduce the need for re-entering card details. In addition, users can set up and manage subscription-based billing for recurring payments.

Key Features:

- Users can set automated refund processes for quick and hassle-free return of funds to customers

- Users can create invoices that comply with Goods and Services Tax (GST) regulations in India

- It provides analytics and reporting features to gain insights into payment trends and customer behavior

- Businesses can create customizable checkout pages for a seamless and branded payment experience

To know more about Razorpay Payment Processing Software features and product options, click here to continue.

9. GoCardless

GoCardless is a payment processing software that facilitates direct debit transactions, allowing businesses to collect payments directly from customers' bank accounts. It can send automated notifications to customers to inform them about upcoming payments, successful transactions, or any issues that may arise. Businesses can use retry logic to reattempt collecting payments in case of initial failures. In addition, it facilitates recurring billing for subscription-based businesses by allowing merchants to set up and manage automated and scheduled payments.

Key Features:

- Provides real-time insights into payment statuses, transaction histories, and other relevant data

- Businesses can gain insights into customer behaviour, payment trends, and other relevant metrics

- Businesses can customize the payment pages to align with their branding to provide a consistent and professional look for customers

- It includes features for managing refunds, allowing businesses to process refunds efficiently when necessary

To know more about GoCardless Payment Processing Software features and product options, click here to continue.

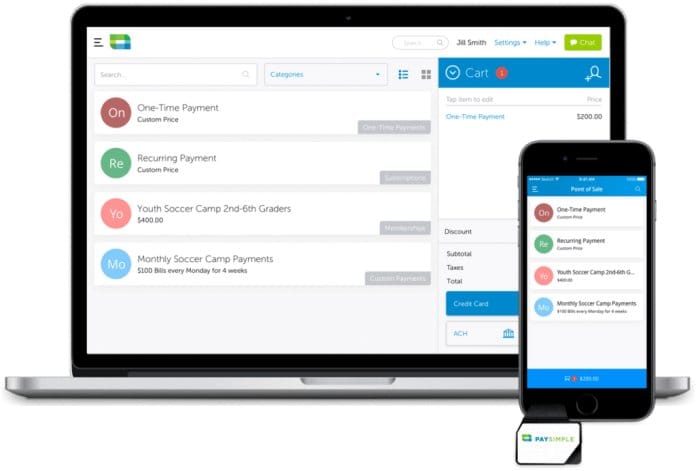

10. PaySimple

PaySimple is a payment processing software that enables businesses to accept payments via credit/debit cards and electronic checks. It supports subscription-based and recurring billing models, making it suitable for businesses that offer services or products with ongoing payments. Businesses can use tokenization of sensitive payment information to enhance security by replacing card data with a unique token. In addition, businesses can refund and handle chargebacks to streamline the process of addressing payment disputes.

Key Features:

- It complies with the Payment Card Industry Data Security Standard (PCI DSS) to protect sensitive payment information

- Allows customers to manage their payment information, view transaction history, and make updates using a self-service portal

- Users can track and analyze financial data and gain insights into payment trends and business performance

- Users can send invoices to customers to collect payments and track payment status

To know more about PaySimple Payment Processing Software features and product options, click here to continue.

Conclusion

Payment Processing Software enables users to create reports on sales, transactions, and customer behaviour for better business insights. It provides two-factor authentication or other authentication mechanisms to enhance the security of customer transactions. In addition, users can generate and send invoices to customers, with integrated payment options for quick and convenient settlement.