What is a CPA Software?

CPA Software allows businesses to track and manage all invoices. Enables users to improve collections by tracking receivables, automating processes, eliminating manual errors, and running comprehensive reports. Allows businesses to optimize customer invoicing and payment processes. CPA Software enables users to ensure that customers pay for the goods or services. It simplifies the processing of large volumes of customer invoices and reduces accountants’ time collecting customer payments. Enables users to provide valuable information for the preparation of regulatory financial reporting. Allows users to match invoices, payments, and credits with quotes and sales orders to process the correct amounts.

CPA Software allows users to process, record, and pay vendor invoices for purchases and services. It includes document matching, approvals, discounts, OCR invoice scanning, bill payments, cash disbursement reports, general ledger posting, etc. Allows users to scan and capture paper documents to convert them into electronic documents. CPA Software also enables users to store invoices in a single repository to search and retrieve invoices as per requirements. Allows users to reconcile invoices and payments automatically and is marked as paid once they receive them. Enables users to customize approval and receive real-time notifications on transactions.

Features of a CPA Software

List of CPA Software

When you start looking for the best CPA software, it is easy to get overwhelmed with the list of options available. Here is the handpicked list of CPA software to choose as per your requirement:

1. Sage Intacct

Sage Intacct is a cloud-based CPA software suitable for small to midsize businesses. It includes accounts receivable, general ledger, real-time reporting, expense management, cash management, etc. It also provides financial reporting, operational insights, and the ability to automate critical financial processes. Sage Intacct CPA software provides in-built templates and balance sheets to track sales and analyze performance. It also integrates with third-party applications such as Salesforce, ADP, etc.

Key Features:

- Available on a monthly and annual subscription

- Complies with GAAP, IFRS, and SAS 70 Type II

- Works on Windows, Mac, and Linux

- Also provides a 30-day free trial

To know more about Sage Intacct CPA Software features and product options, click here to continue.

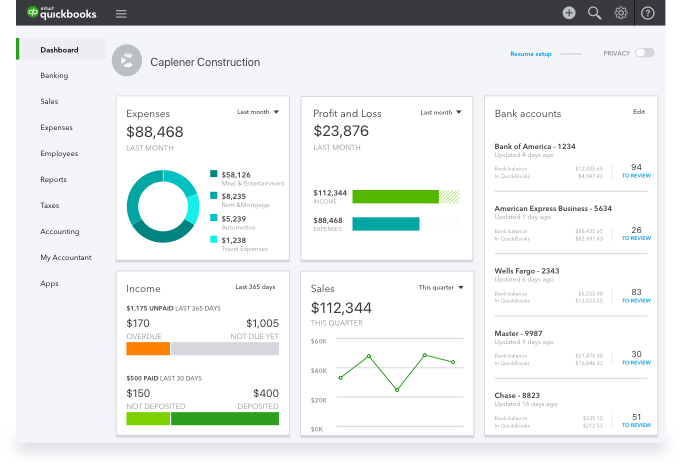

2. QuickBooks

QuickBooks Online is a cloud-based CPA software suitable for businesses of all sizes. Provides a centralized dashboard that enables users to gain insights into organizational performance using key performance indicators (KPIs). Allows users to manage expenses, projects, invoices, etc. QuickBooks Online CPA software enables users to set permissions, assign tasks to individuals, provide access to specific individuals, and collaborate on projects with team members.

QuickBooks Online allows users to sync business finance into one dashboard where multiple users can view in-depth reports and accounts of the company’s finances. Allows users to capture digital copies of receipts and automatically sort transactions based on categories. Available on a monthly subscription. It also provides a free 30 days trial.

Key Features:

- Allows users to integrate with third-party applications, such as PayPal, Salesforce, Xero, etc

- Also provides a mobile app for iOS and Android

- Enables users to create custom reports and feed on them within the dashboard

- Enables users to back up data to the cloud for record-keeping

To know more about QuickBooks CPA Software features and product options, click here to continue.

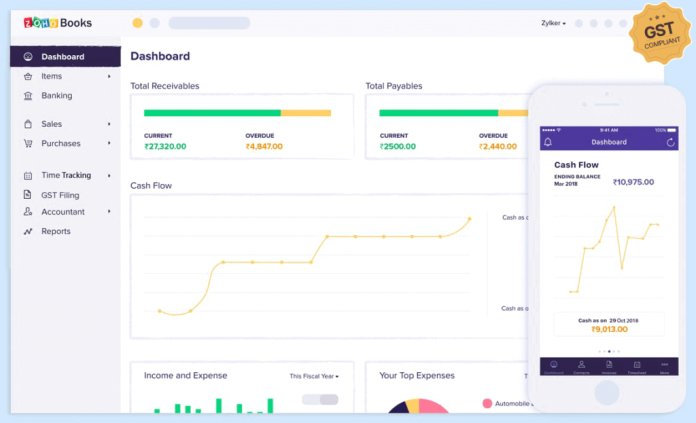

3. Zoho Invoice

Zoho Invoice is a cloud-based CPA software suitable for businesses of all sizes. It includes time tracking, reporting/analytics, customizable templates, automated tracking expenses, etc. Provides in-built templates that allow users to create customizable invoices with the brand logo. Zoho Invoice CPA software allows users to send automated payment reminders to clients for pending payments and share invoices with team members to facilitate collaboration.

Zoho Invoice allows users to create estimates, send invitations to clients, add comments, and convert them into invoices. Enables users to collect advance payments and keep track of invoice history. Available on a monthly subscription. It also provides a free version with limited features.

Key Features:

- Integrates with third-party applications, such as Office 365, Slack, G Suite, etc

- Supports multiple languages, such as German, English, French, etc

- Allows users to set permissions and determine access to individuals as per requirements

- Also provides a mobile app for iOS and Android

To know more about Zoho Invoice CPA Software features and product options, click here to continue.

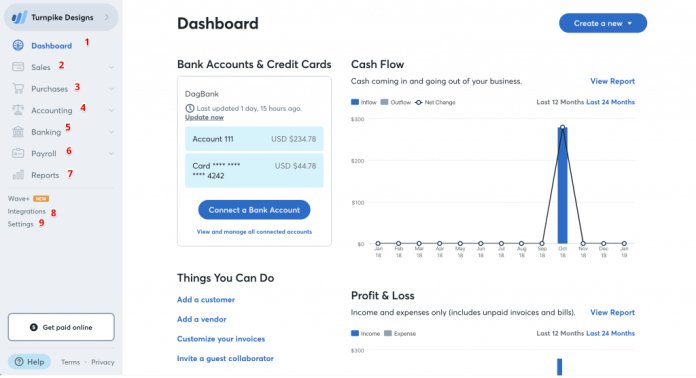

4. Wave

Wave is a cloud-based CPA software suitable for small businesses. It includes invoicing, billing, payment tracking, credit card processing, receipt scanning, etc. Allows users to manage accounts and credit card information in real-time to improve bookkeeping accuracy and efficiency. Wave CPA software also enables users to generate reports, such as balance sheets, sales tax, cash flow, etc. Allows users to send payment links and invoices via email to collect payments.

Key Features:

- Allows users to choose customizable invoicing templates as per requirements

- Provides a mobile app for iOS and Android

- Available on a monthly subscription

- Also available for free with limited features

To know more about Wave CPA Software features and product options, click here to continue.

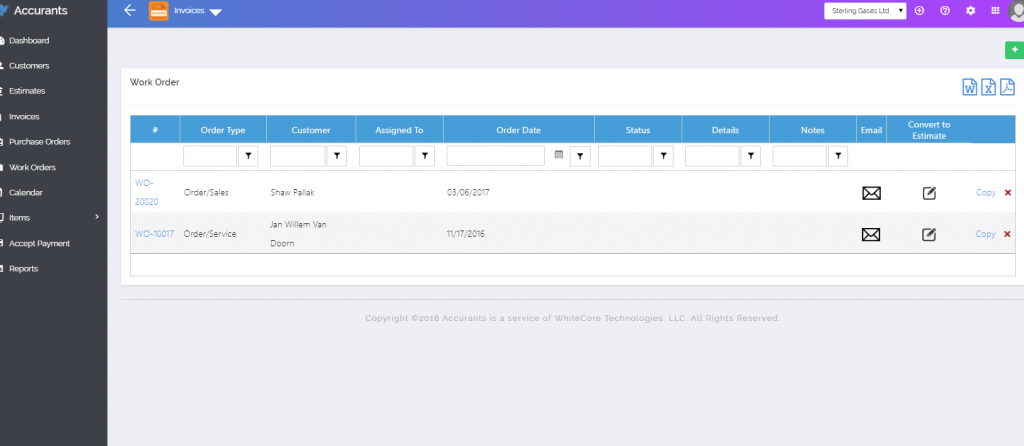

5. Accurants

Accurants is a cloud-based CPA software suitable for small businesses. It includes time tracking, invoicing, expense tracking, etc. Allows users to create invoices and receive payment via mobile devices. Accurants CPA software enables users to create estimates and convert them into invoices. Allows users to create and send purchase orders.

Accurants allows users to export invoices in PDF and Excel format and attach documents with the invoices in PDF, Excel, and Word. Enables users to integrate with third-party applications such as QuickBooks.

Key Features:

- Available in three different plans – Basic, Plus, and Enterprise

- Available on a monthly subscription

- Provides a mobile app for iOS and Android

- Also provides a free trial version

To know more about Accurants CPA Software features and product options, click here to continue.

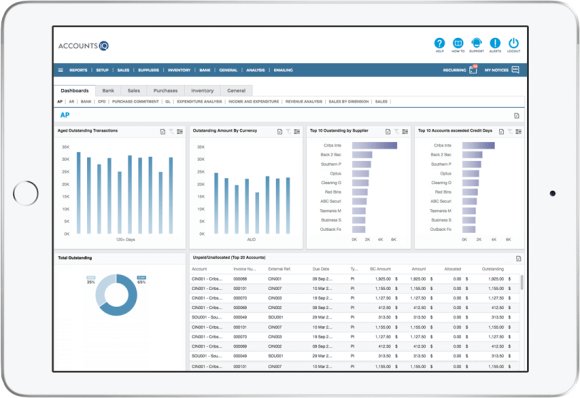

6. AccountsIQ

AccountsIQ is a cloud-based CPA software suitable for small to medium-sized businesses to capture, process, and report financial data. It includes managing budgets, digital VAT returns, automated consolidation, etc. AccountsIQ CPA software allows users to measure actual results compared with planned budgets to analyze consistencies and performance.

AccountsIQ enables users to create budgets in different currencies and streamline workflow approvals of purchase orders and invoices. It also provides customizable charts of accounts, GL coding, etc.

Key Features:

- Integrates with third-party applications such as Kefron, Salesforce, concur, etc

- Also provides a free trial version

- Provides a mobile app for iOS and Android

- Available on a monthly subscription

To know more about AccountsIQ CPA Software features and product options, click here to continue.

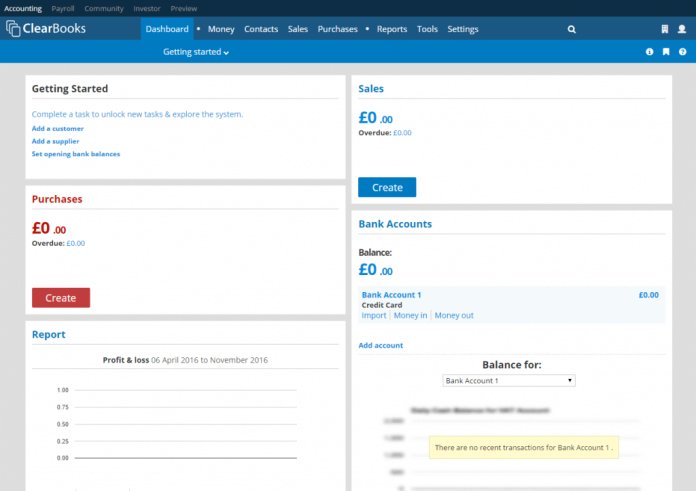

7. Clear Books

Clear Books is a cloud-based CPA software designed for small businesses. It includes fixed asset registers, purchases, sales, and reports. Enables users to send automatic payment reminders and supports multiple currencies to create customizable invoices. Clear Books CPA software allows users to create invoices and view them as HTML or saved as pdf files. Enables users to view balance sheets, profit and loss statements, audit logs, etc.

Clear Books allows users to import bank statements and reconcile statements for multiple accounts. Enables users to integrate with third-party applications like PayPal, MailChimp, Commusoft, FreshBooks, etc. It also provides a 30-day free trial.

Key Features:

- Enables users to export invoice data to view in a spreadsheet such as Microsoft Excel

- Enables users to export invoice data to view in a spreadsheet such as Microsoft Excel

- Allows users to send reminders to chase overdue debts automatically

- It also provides a mobile app for iOS and Android

To know more about Clear Books CPA Software features and product options, click here to continue.

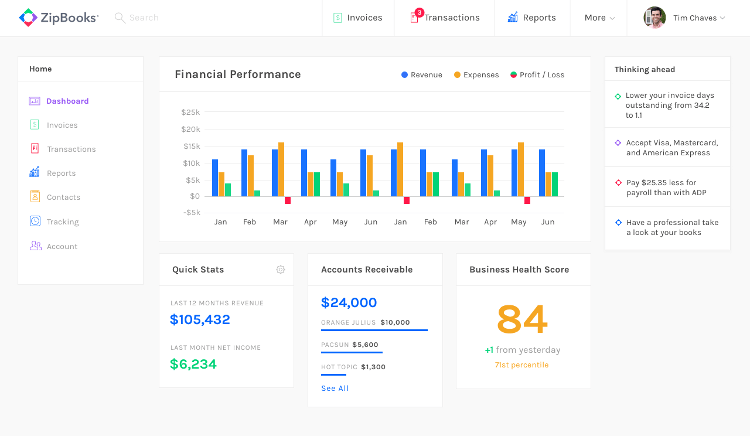

8. ZipBooks

ZipBooks is a cloud-based CPA software suitable for small to midsize businesses. Allows users to create customizable invoices with logos, themes, and messages. Enables users to import transactions and generates real-time expense reports automatically. ZipBooks CPA software allows users to create and assign tasks to team members and track performance with an in-built time tracker. It also provides a free version with limited features.

Key Features:

- Enables users to create estimates and convert them into invoices once approved by customers

- Allows users to send payment reminders to a customer via email automatically

- Allows users to integrate with third-party applications, such as Google Drive, Slack, Asana, etc

- Also supports multiple currencies

To know more about ZipBooks CPA Software features and product options, click here to continue.

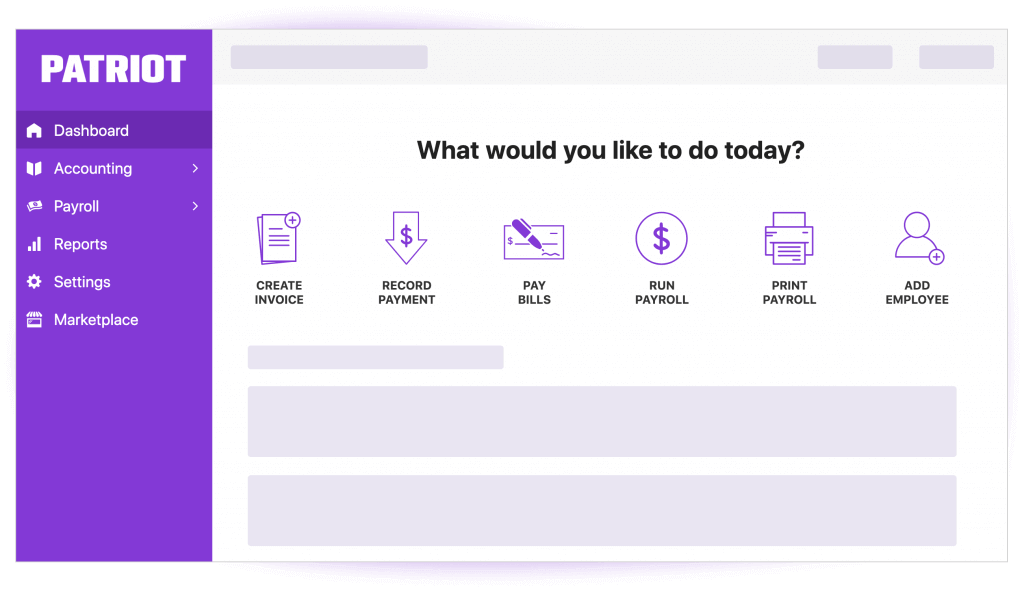

9. Patriot

Patriot is a cloud-based CPA software suitable for small businesses. Allows users to track customer invoices and print invoices. Enables users to issue 1096 and 1099 tax forms and draft vendor invoices. Patriot CPA software allows users to export spreadsheets with financial summaries for specified timeframes. Enables users to view balance sheets, profit, and loss statements, vendor payments, etc.

Patriot allows users to set default prices for products and services and specify the sales tax rate. Enables users to view unpaid invoices and record payments from customers. It also provides a 30-day free trial.

Key Features:

- Allows users to create payment reports for multiple vendors for a specified date range

- Integrates with other Patriot products, such as Patriot payroll software

- Enables users to import transactions and upload a file from the bank and reconcile accounts

- Available on a monthly subscription

To know more about Patriot CPA Software features and product options, click here to continue.

10. LessAccounting

LessAccounting is cloud-based CPA software suitable for businesses of all sizes. Allows users to categorize expenses, record expenses, send invoices, etc. Enables users to import address books from Basecamp and Gmail. LessAccounting CPA software allows users to send invoices to customers via email and track payments. Provides in-built templates that enable users to create customizable invoices and set recurring invoices.

Key Features:

- Enables users to create estimates and convert them into invoices once approved by customers

- Allows users to create custom reports and filters by client, date, tags, etc

- Integrates with third-party applications, such as Stripe, PayPal, Basecamp, etc

- Also provides a 30 days free trial

To know more about LessAccounting CPA Software features and product options, click here to continue.

Conclusion

CPA Software eliminates manual processes and reduces accounts payable workload, human error, and fraud to speed up day-to-day accounts payable processes. Allows users to manage large volumes of invoices and financial transactions. Enables users to escalate bottlenecks and ensure timely processing and posting of invoices. CPA Software also provides a mobile-optimized solution that enables users to view and manage invoices anywhere.

CPA Software allows users to automate their receivables processes and improve collections. Enables users to manage their customer accounts with detailed information and reporting quickly. Allows users to specify the currency on the invoices. Enables users to create reports and analytics on the status of invoices, payments, customer credit, and transaction history.